duluth mn restaurant sales tax

Attorneys Office of Minnesota said Shimon Shaked 57 listed his teenage daughter as the nominal owner of his holding company in order. The Minnesota sales tax rate is currently.

Specialty Buffets Dry Dock Duluth

Majestic Life Church Riva Tims.

. The minimum combined 2022 sales tax rate for Duluth Minnesota is. Inver Grove Heights MN Sales Tax Rate. A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales taxes.

For more information see Fact Sheet 164 Local Sales and Use Taxes. In 2020 despite the pandemic Minnesotas historic tax credit led to 1765 million worth of economic activity including 498 million in wages paid to. Duluth mn restaurant sales tax.

The Duluth Sales Tax is collected by the merchant on all qualifying sales made within Duluth. A Duluth souvenir store owner who is accused of evading more than 800000 worth of income tax was charged in Minneapolis Thursday. Eagan MN Sales Tax Rate.

Eden Prairie MN Sales Tax Rate. Cottage Grove MN Sales Tax Rate. The money is from a ½ percent sales tax that a majority of Duluth voters approved by referendum in 2017.

Coon Rapids MN Sales Tax Rate. This 15 percent sales tax applies to retail sales made into Duluth. Duluth in Minnesota has a tax rate of 838 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Duluth totaling 15.

Duluth restaurant owners charged with tax fraud. See reviews photos directions phone numbers and more for the best Tax Reporting Service in Duluth MN. District Court in Minneapolis with tax evasion failure to file a tax return and failure to account for and pay employment tax.

Italian Restaurant Detroit Lakes Mn. Monday - Friday 800 - 430pm Contact the City. Duluth is in the following zip codes.

Authorities said Osaka Sushi Hibachi Steak House used. Louis County District Court and were ordered to pay nearly 300000 in restitution. Food and Beverage establishments must collect 225 for the Food and Beverage Tax.

All Lodging establishments must collect 30 for the Lodging Excise Tax. Contact Us Duluth City Hall 411 W 1st Street Duluth MN 55802 218730-5000 Hours. Shaked owns multiple souvenir stores in the Canal Park area of.

Lauras Income Tax Services. If the items you are buying are for your personal use you can buy up to 770 worth of taxable items during the calendar year without paying use tax. The County sales tax rate is.

Fiesta Mexicana Restaurant Menu. 4 rows Higher sales tax than any other Minnesota locality. Sales are reported and tax collected is remitted to the City of Duluth Treasurer.

The owner of a number of Duluth t-shirt and souvenir shops has been sentenced to a year and a day in prison and ordered to repay more than 600000 in restitution after pleading guilty to tax evasion. The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. The Duluth sales tax rate is.

27 1906 115 years ago today by w. Lakeville MN Sales Tax Rate. If however your purchases total more than 770 you must pay use tax.

You can find more tax rates and allowances for Duluth and Minnesota in the 2022 Minnesota Tax Tables. Youll likely need a business license to open a cafe or restaurant in Duluth. The use tax applies to taxable items used in the City if the local sales tax was not paid.

Those with more than 30 units must also collect an additional 25 Lodging Tax. This is in addition to any other local or state licenses that may be required in Duluth. Call us at 218 723-5281.

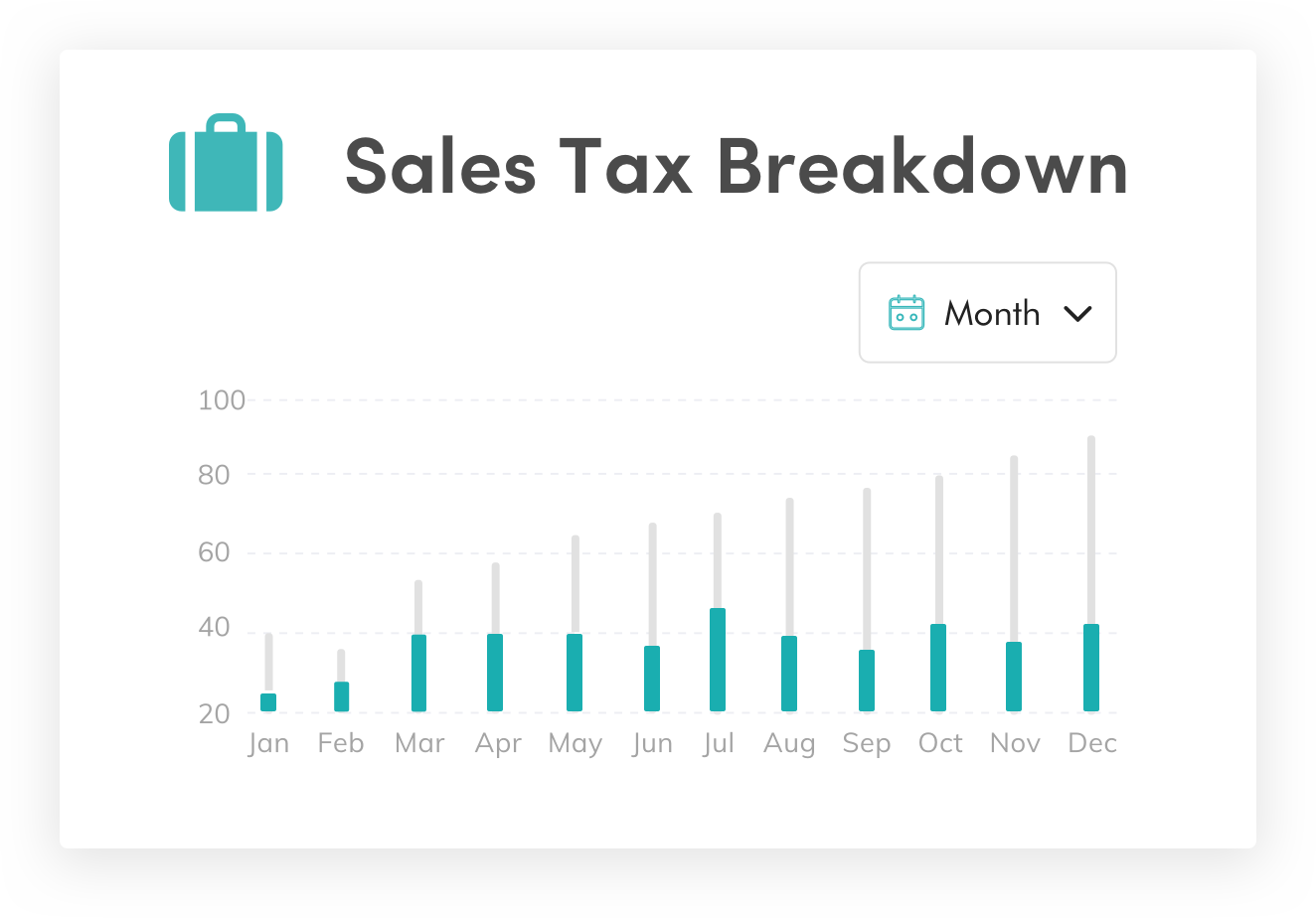

Sales Tax Breakdown Duluth Details Duluth MN is in Saint Louis County. Duluth hotel restaurant sales tax on track for return. Duluth MN Sales Tax Rate.

Burnsville MN Sales Tax Rate. Duluth Mn New Sales Tax. SalesUse Tax Duluth City SalesUse Tax Duluth Tourism Additional Food Beverage Tax Duluth Tourism Lodging Excise Tax Duluth Tourism Additional Lodging Tax Total Tax 6875 05 15 225 11125 6875 25 05 15 225 13625 6875 05 15 30 11875 6875 05 15 30 25 14375 6875 05 15 8875.

The current total local sales tax rate in Duluth MN is 8875. By Peter Passi on Jul 14 2014 at 1042 pm. Where is the money coming from to fund this Street Improvement Program.

Restaurants In St Cloud Mn Open For Thanksgiving. El Rancho Restaurant Menu. The 8875 sales tax rate in Duluth.

The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Edina MN Sales Tax Rate. By helping to relieve the tax burden of duluth households if glensheen did not exist each of duluths 35000 households would have to pay an additional 37 per year in taxes to maintain current state local tax levels.

Two Duluth restaurant owners were convicted of felony tax crimes Tuesday by the St. This is the total of state county and city sales tax rates. 55801 55802 55803.

Than 27000 in sales tax revenue and the city of Duluth of more than 7800 in local sales tax revenue the Department of Revenue said in a. On top of your business license you may need a. Duluth Sales Tax Street Improvement Program FAQs Page 1 of 3 Sales Tax Street Improvement Program for 2022 FREQUENTLY ASKED QUESTIONS Background.

The December 2020 total local sales tax rate was also 8875. Shimon Shaked 56 is charged in US. You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state.

Minnesota Sales And Use Tax Audit Guide

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Sales Taxes In The United States Wikiwand

Duluth T Shirt And Souvenir Shop Owner Imprisoned For Tax Evasion Bring Me The News

Sales Taxes In The United States Wikiwand

Minnesota Clothing Sales Tax Exemption Appreciation Perfect Duluth Day

St Louis River Corridor Plan Hinges On Tourism Tax Statewide Minnesota Public Radio News

Duluth Restaurant Owners Convicted For Using Zapper Software To Hide 290k In Sales Tax Revenue Twin Cities Business

Minnesota Income Tax Calculator Smartasset

Sales Tax Consulting Advisory Services Financepal

Sales And Use Tax What Is The Difference Between Sales Use Tax

Minnesota Sales Tax Information Sales Tax Rates And Deadlines